Commercial property insurance provides protection for property owners that they let out to third parties for commercial uses. This type of insurance policy is important due to the variety of costly incidents that can stem from allowing another party to occupy a commercial property, such as barns or steel structures.

This cover is also often referred to as commercial landlord insurance. To qualify for this type of policy, a property owner must have a formal rental agreement in place with their tenant that establishes themselves as the landlord and the occupying organisation as the tenant.

What Does a Commercial Property Insurance Policy Cover?

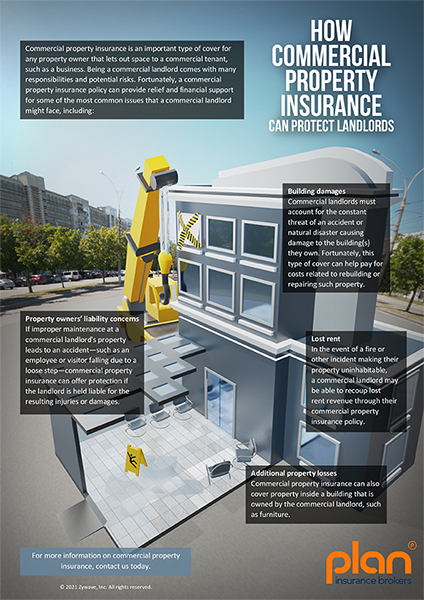

A commercial property insurance policy comes with cover for a number of different types of incidents that may affect the property that you own. Policyholders may be able to recoup costs and receive financial aid in a variety of situations, such as:

- Liability for injury or damage – In the event of property damage of personal injury occurring due to a landlord being negligent in maintaining the property, the property owner will be held responsible.

- Necessary repairs – If a building or property is damaged and must be repaired or rebuilt, commercial property insurance plays a key part in covering the resulting costs.

- Loss of rent – If a property becomes unfit to be let due to an insurable event—such as a fire—the loss of rent can be recouped through commercial property cover.

- Damage to landlords’ contents – It is possible that landlords will own not only a building but also some of the contents inside, such as utilities in the kitchen. Commercial property policies will also provide cover for such contents.

Furthermore, there are additional situations that commercial property insurance can provide cover for which may not generally be included in a standard policy. These options might include cover for intentional property damage committed by a tenant or legal fees.

For more information regarding commercial property insurance, please click here

Special Considerations

It is important for policyholders to understand all aspects of their commercial property insurance. This includes whether or not a policy will be triggered by certain specific situations, such as:

- Unoccupied properties – Due to unoccupied properties having a higher risk of break-ins, vandalism, squatting and other crime, most brokers will not cover unoccupied properties under commercial property insurance. There is generally a grace period of approximately 30 days between when a property becomes vacant and when the owner will be required to switch to a vacant property insurance policy.

- Wear and tear – Buildings and property will inevitably require regular maintenance, which is not covered by commercial property insurance. Policyholders should take the time to understand exactly what types of damage their insurance will cover, and what types will be considered general wear and tear.

- Flat roof warranty – Flat roofs are consistent concerns for insurance providers due to the increased risk of leaks and resulting property damage. If a property’s roof has flat sections, a policy may require owners to perform certain servicing and repairs on a regular basis.

Domestic Landlord Insurance Differences

Property owners must understand the differences between commercial property insurance and domestic landlord insurance. The two primary distinctions that should be understood include:

- Tenant types – It is important for an insurance policy to be composed relative to the potential risk that a landlord’s tenants may pose. For example, a domestic tenant may generally be considered lower risk due to it being less likely that they will be using industrial equipment or handling hazardous substances.

- Building types – Commercial properties may come with a wider variety of building materials or infrastructure. Therefore, they may be accompanied by additional hazards or potential costs. These factors—such as complex electrical systems or asbestos—must be taken into account by an insurance provider.

In Conclusion

Letting out property to third parties comes with inevitable risks. While acting as a landlord can be profitable and rewarding, it also presents many exposures. Ensure that your property is properly protected.

For more information and assistance with your commercial property insurance, contact us today.