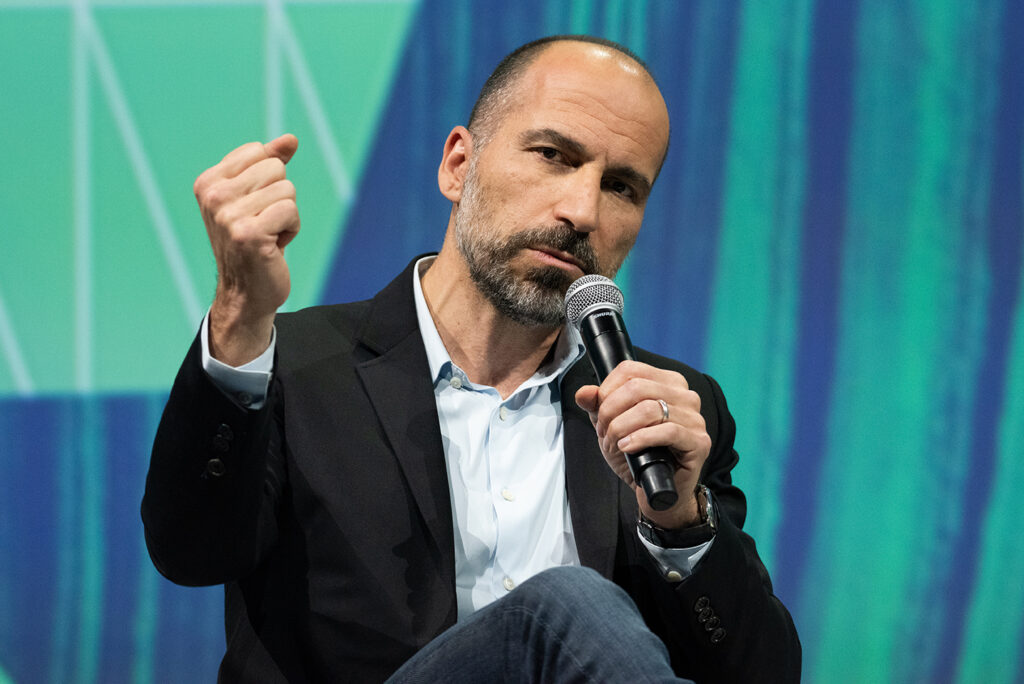

Uber CEO Dara Khosrowshahi is in line for a bumper pay packet after overseeing a remarkable turnaround in the company’s fortunes. The company’s improved share price has unlocked options for him to purchase stock valued at around $136 million.

The board of the ride-hailing company set him the performance target of achieving a $120 billion valuation. This has now been easily passed with Uber’s stock price jumping by almost 150% in the last year to reach $160 billion.

Plan Insurance can provide bespoke taxi insurance quotes for all UK drivers. Just fill in our short online questionnaire, and our professional brokers will be in contact to arrange your insurance.

Uber went public in 2019. In the following years its market capitalisation averaged at approximately $45 billion. Annual losses of several billion dollars were persistent. However since Khosrowshahi took the helm results have improved dramatically. The company’s equity value sustained an average of at least $120 billion over 90 trading days up to February 6th.

In fact, Uber only reported its first ever annual operating profit as a limited company this year. It was a significant moment for the business and its investors after 14 years. After a forceful, often controversial and expensive rise to Global dominance the Holy Grail of profitability had been achieved. The app operator stated that it made $1.1 billion during 2023. That contrasted to a loss of $1.8 billion across the previous year.

Whilst at Expedia Khosrowshahi was previously the best-paid chief executive in the S&P 500 share index. He joined Uber in 2017 and sacrificed $160mn in options to do so. His deal at Uber included receiving options over 1.75 million shares if the $120 billion value was achieved for a minimum period of time. He also had to remain in his role for 5 years. Uber credits Khosrowshahi with playing a “critical role” “in Uber’s transformation plan”.

Other senior executives will also have had lucrative compensation connected to the valuation hurdle being overcome. Khosrowshahi’s options will cost him a total of $59 million to exercise with each share valued at $33.65. He has until September to utilise the options. The figures are not uncommon for large American tech firms. The likes of Tim Cook at Apple, Sundar Pichai at Alphabet and Andy Jassy at Amazon have received similar eye watering amounts based on performance.

Khosrowshahi steadied the ship at Uber after former CEO and founder Travis Kalanick resigned in 2017. Kalanick had been embroiled in a number of privacy scandals and complaints of inappropriate behaviour. Khosrowshahi successfully reduced costs, increased margins, generated income from new activity such as advertising and dispensed with non-essential investments such as those deployed on the development of autonomous vehicles.

His methods have clearly worked. It would be difficult to deny the contrast from before and after he assumed the CEO role at Uber. However many drivers may be less enthused by the discrepancy in their own financial circumstances.