In recent months, UK house prices have experienced a noticeable uptick, capturing the attention of homeowners, potential buyers, and investors alike. This surge reflects various economic and market trends that influence property values. In this blog post, we will delve into the latest developments in the property market, explore the impact of mortgage rates on housing, and provide a forecast for the remainder of 2024.

Current Property Value Updates and Trends

The UK housing market is currently experiencing significant fluctuations. According to recent reports, there has been a notable price increase in several regions, driven by high housing demand and limited supply.

According to the latest data from the Office for National Statistics (ONS), the UK housing market has experienced increased property values over the past year. Key highlights include:

- Annual Growth: House prices increased by 2.2% in the year to May, reaching an average of £285,201.

- Monthly Increase: Property values rose by 1.2% in May compared to April.

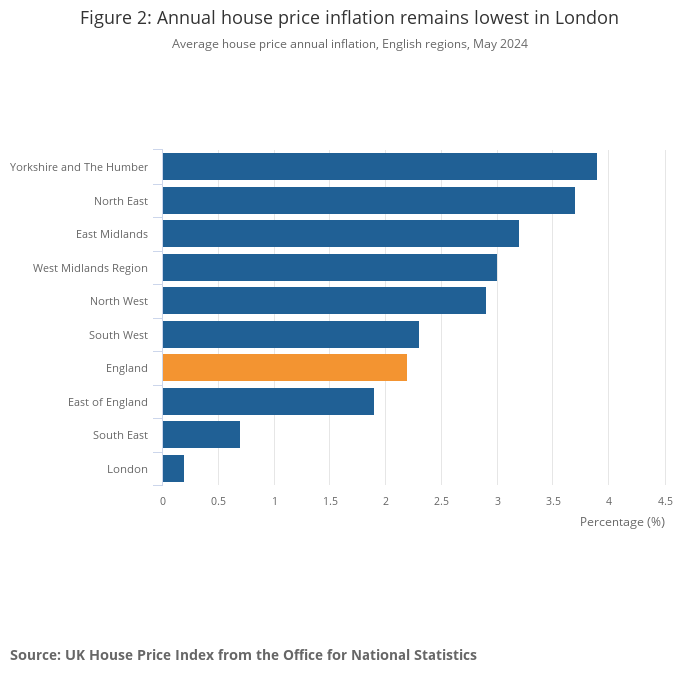

- Regional Variations:

- Yorkshire and the Humber saw the highest annual increase in England at 3.9%, with average home prices now at £209,055.

- London recorded the lowest annual growth, with prices rising only 0.2%, maintaining the highest average value at £523,376.

- Northern Ireland experienced a 4.0% rise, bringing the average home price to £178,499.

- Wales and Scotland saw increases of 2.4% and 2.5%, respectively, with average prices at £216,002 and £191,435.

- Property Types:

- Detached and semi-detached homes saw strong growth, with values up by 3.5% and 3.9%, respectively.

- Flats and maisonettes faced a decrease of 0.9% in average prices, particularly affecting the first-time buyer market.

The Impact of Mortgage Rates on Housing

Mortgage rates play a critical role in determining housing affordability. Recently, the UK has seen shifts in these rates, directly impacting home sales and property values. Higher mortgage rates often lead to reduced purchasing power for buyers, which can slow down the market. Conversely, lower rates typically encourage more buyers to enter the market, driving up demand and house prices. Monitoring these rates is essential for buyers and sellers to make informed decisions.

There is speculation that in the coming days the Bank of England will cut the base rate for the first time in over four years. A poll of economists, carried out by the news agency Reuters, revealed that the overwhelming majority of experts expect the Bank of England to the rate from its 15 year high of 5.25% to 5% during their August meeting. However, markets are less convinced. A marginal majority of 54% anticipate rates remaining at their present level, whilst 46% have priced in a cut.

Plan Insurance can accommodate your Property Owners & Landlord Insurance needs. Just fill in our short call back form, and our professional brokers will be in contact to arrange your insurance.

Housing Demand and Supply Trends

Housing demand and supply dynamics are central to understanding the property market. Currently, the UK is experiencing a high demand for housing, partly fuelled by a growing population and changing lifestyle preferences, such as the desire for more spacious homes post-pandemic. However, the supply side is struggling to keep up, leading to increased competition and rising prices. This imbalance between supply and demand is a significant factor behind the recent price increases.

Jeremy Leaf, north London estate agent and a former RICS residential chairman, said: “The figures reflect the period in particular before the announcement of the election, but that event put the brakes on activity for some as it created considerable uncertainty. Many will hope today’s announcement of inflation holding steady (at 2%) and on target will hasten the albeit small likely drop in Bank of England Bank Rate next month, which is of more relevance to decision-making.”

Economic Factors Influencing House Prices

Several economic factors influence house prices, including inflation, employment rates, and overall economic growth. The effects of inflation on home prices are particularly notable, as higher inflation typically leads to increased costs for building materials and labour, further driving up property prices. Economic uncertainty can dampen or boost market activity, depending on consumer confidence and spending power.

Regional Property Price Differences

As mentioned earlier, house price trends vary significantly across different regions in the UK. For instance, London continues to command some of the highest property values, while other regions, like the North East, are experiencing more moderate growth. Understanding these regional differences is vital for buyers looking to invest in areas with the highest potential for appreciation or for sellers aiming to capitalise on current market conditions.

Real Estate Market Analysis and Forecast

Analysing the current state of the real estate market provides valuable insights into future trends. Experts predict that while house prices may continue to rise in the short term, there could be a stabilisation or even a slight decline if mortgage rates increase further or economic conditions worsen. The housing market forecast for 2024 suggests a cautious approach, with potential buyers advised to stay informed about economic factors influencing house prices and market trends.

Navigating the Property Market

The UK housing market is currently experiencing rising property prices, driven by various economic and market factors. Key elements such as mortgage rates, housing demand and supply, and regional price disparities play a significant role in shaping the market. Whether you’re a first-time buyer or a seasoned investor, being aware of the latest market trends and forecasts is essential for making informed decisions.

Find out why 96% of our customers have rated us 4 stars or higher, by reading our reviews on Feefo.