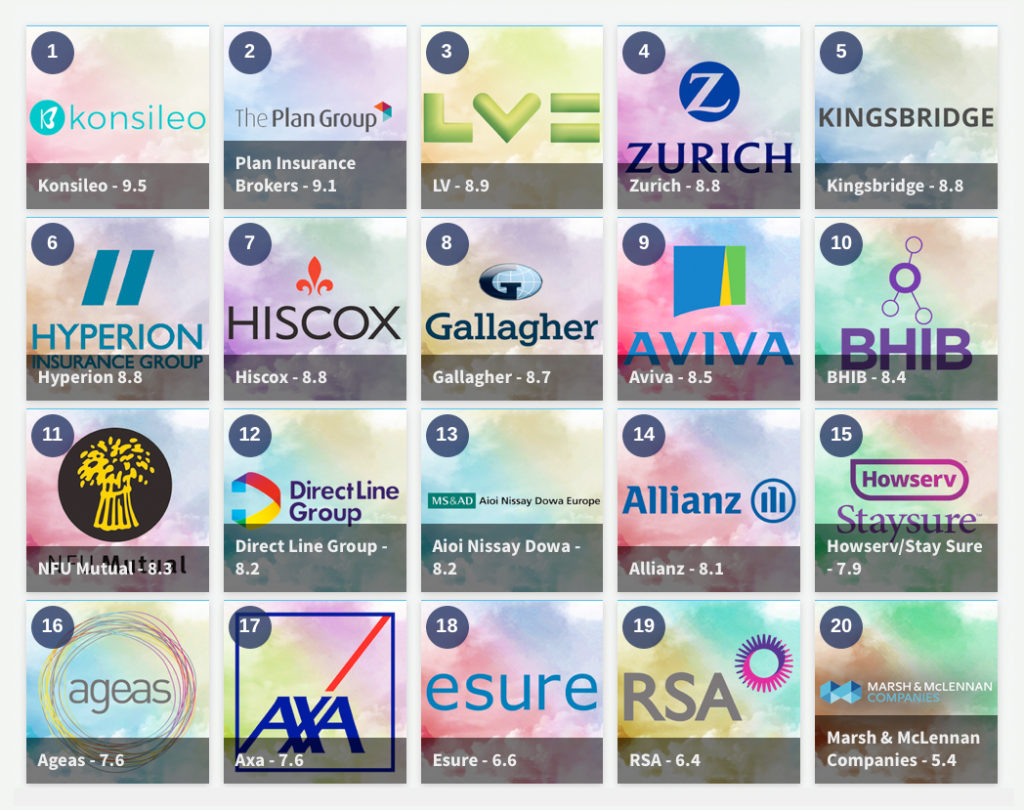

We are extremely proud to be ranked 2nd in the “Best Insurance Employer 2020” awards by the Insurance Post.

In a somewhat ironic twist, with the current world event, our employees are officially banned from the office under government guidelines introduced because of the Covid-19 epidemic… however we would like to announce we recently finished as a runner up in Insurance Post’s “Best Insurance Employer 2020” while only being bested by Konsileo Insurance Brokers.

Susie Wilson our Head of Human Resources and Performance gives her take on why we have strived to invest in and develop our employees, in order to create an efficient and productive company infrastructure that can rival larger insurance brokers.

Please scroll down for the Post’s interview with Susie Wilson.

Why do you think your employees have nominated The Plan Group in this survey?

Despite the business growth in recent years, there remains a fun family atmosphere along with a focus on investing in our employees and a drive to take pride in the service we deliver.

What do you believe employees value the most?

Encouragement to progress, recognition for hard work and an open-door policy, where we listen to employee suggestions and put them into practice where possible.

How does this tie into your company values?

Ethics is at the core of the HR team. We are a friendly team who lead by example and build trustworthy relationships across the business. This has meant that colleagues find us approachable and this, in turn, enables us to demonstrate our knowledge and have input on decision-making. We investigate decisions thoroughly in order to choose the right course of action and maintain a strong and sustainable workforce.

How does staff feedback affect HR decisions?

We carry out an annual employee survey as well as operate a suggestion box. These are fed back to the senior management team who look at suggestions that have been made, and if we can put them into practice we will and if not we will feedback why it isn’t possible. We have an employee focus group made up of representatives from all areas of the business. A lot of HR decisions will be sounded out among the group and we welcome feedback from them and shape new policies with the employees’ opinions at the forefront of our decision-making.

How do you retain staff?

We carry out annual pay and benefits reviews to ensure that we are offering what is expected in our area and in the market. We are competing with some large companies locally, so it is difficult to offer what they can in some instances, however, we foster an environment where people enjoy coming to work, we have invested in an attractive workspace and offer flexible working where possible. We also ensure that everyone has regular one to ones and annual appraisals; the management that carries out these meetings have regular training and monitoring to ensure they are effective and followed through.

Do you do anything differently from other insurance firms?

We put our employees first and ensure that the management team have the skills to be able to develop and motivate their employees. Feedback has told us that employees feel that we invest in them, from encouraging social events within teams to introducing our office bookshelf, with literature that can help employees develop their skills independently. We have also invested in a social media-based intranet which encourages people to liaise with others in the business in a more engaging manner; this has led to better inter-department relationships and we have been able to move away from sending monotonous ‘HR’ emails to the business.

Where do you think HR is going in the future?

The role of HR is evolving. In the past it was seen as transactional and personnel-based, however, we are moving towards a more strategic support role for all areas of the business. HR is there to assist with organisation and job design, change management and ensure that ethics are promoted in all areas of the business to uphold professionalism both internally and externally.

In your experience is recruiting and retaining employees in insurance different from other sectors?

Recruitment varies from department to department. We don’t tend to have many temporary or short-term employees and people tend to be more career-based as insurance offers a stable, long-term future with strong career progression.

What advice would you give to other firms to replicate your success?

Don’t just invest in the professional development of your employees but ensure that you invest in their general wellbeing. It is also important to look at factors that may adversely contribute to this; for example addressing financial issues, promoting a healthy work/life balance and encouraging a healthy lifestyle. This will ensure that employees are happy and productive, meaning they will repay you with increased self-belief and personal drive.