You might have noticed that researching second-hand motor prices has felt a bit different lately. Prices aren’t plummeting, new deals keep popping up, and everyone seems to be talking about the booming used car market.

According to recent data from Cap HPI, used car prices remain remarkably stable, thanks to limited stock and a surprisingly high demand. In this article, we’ll explore current used car market trends, highlight the factors influencing used car prices in 2025, and see why buyers and traders are feeling fairly optimistic about the months ahead.

A Record Start for 2025

Despite broader economic concerns, early figures show that traders are selling used cars at a record pace. With the average retail price holding steady at around £16,774. Demand for used vehicles continues to soar, helped by roughly 87.1 million cross-platform visits tracked by one leading online marketplace in January alone. This level of consumer appetite is reminiscent of last year’s strong performance, and experts predict that the used car market may rise from around 7.61 million sales in 2024 to about 7.70 million in 2025.

Consumers appear undeterred by economic ups and downs. In fact, more than half of prospective car buyers recently surveyed felt more confident about affording their next car purchase than they did a year ago. That confidence translates into brisk sales, with cars leaving dealer forecourts faster than in previous years.

Slight Shifts in Used Car Values

Over the three-year, 60,000-mile benchmark, used car values saw only a minuscule decline of 0.1% (around £60). Considering it’s the joint fourth-strongest January performance on record, that’s not too shabby. Although some might expect dramatic price rises straight after the festive period, data stretching back to 2012 suggests that January gains are typically minor.

Meanwhile, one-year values slipped by around 0.3% (close to £150), influenced by exciting new car deals and discounted pre-registered models. There was a 0.4% (£10) lift at the five-year mark, while 10-year-old models got a 1.6% (£60) bump. Condition plays a massive role in these older vehicles – cars in tip-top shape can fetch well above that modest average increase.

Electric vehicles are both a blessing and a challenge. With fewer moving parts, EVs require less routine maintenance, which is great news for consumers but less so for garages. Only 21% of garages expect EVs to significantly contribute to their income in 2025, down from 26% in 2024 and 32% in 2023. While the shift to EVs aligns with a greener future, garages will need to adapt their training procedures along with their revenue models to offset the reduced maintenance demand.

If your business buys, sells, repairs or modifies vehicles then Plan Insurance Brokers can source a tailored Motor Trade insurance policy for you. If you have any more questions or would like a quote call our expert team, request a call back or fill in a quote form.

Diesels, Hybrids, and EVs

When it comes to fuel types, diesel surprisingly emerged as the winner at the three-year benchmark, edging up by 0.2% (roughly £40). Hybrids stayed flat, and petrol dipped by 0.1% (about £60). Plug-in hybrids recorded a 0.6% (£175) slide, while electric vehicles saw a 1.1% (£240) drop. Although EVs took the biggest hit this month, they were the fastest-selling fuel type for many retailers, and forecasts suggest they’ll rebound in the coming weeks.

The Impact of Economic Conditions on the UK Used Car Market

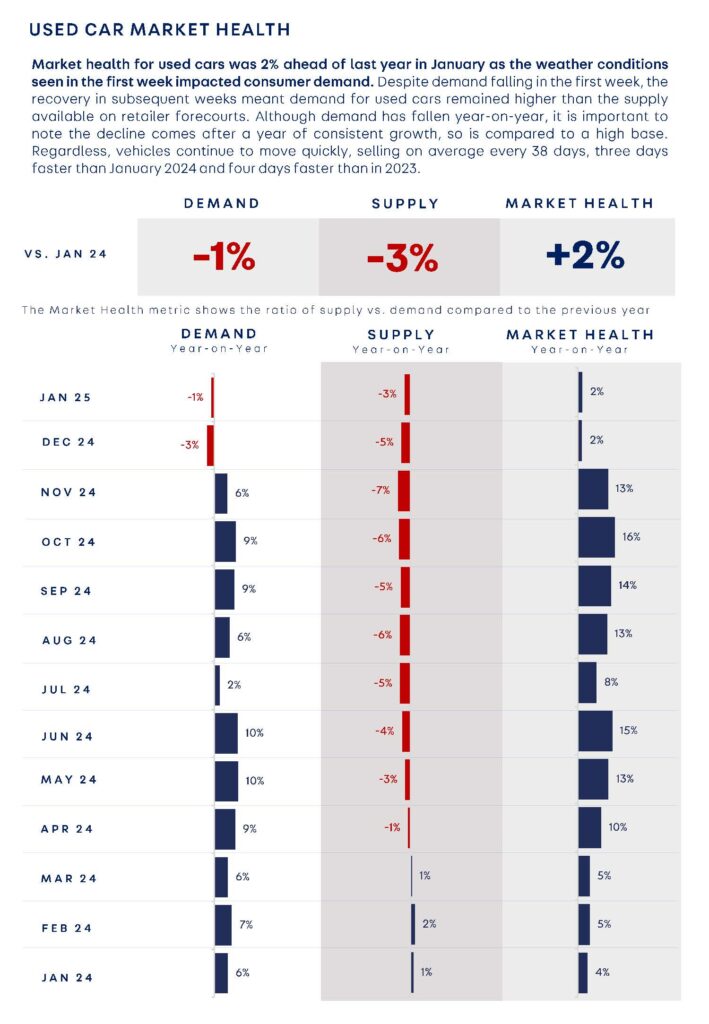

So, what’s driving these numbers? In many ways, it’s the classic case of supply and demand. Post-Covid, the market for used cars is still tight, with supply down by around 3.1% year-on-year (Source: Auto Trader). At the same time, consumers are shopping in droves, which is underpinning prices. While wider economic factors – inflation, employment rates, and budget changes – may create bumps in the road, the outlook for the average price of used cars in the UK for 2025 stays encouraging.

Looking at the comparison of used car prices across UK regions in 2025, local economic conditions, demand levels, and stock availability inevitably vary from region to region. Overall, the national trend suggests prices are holding firm and show no signs of a sharp dip.

What This Means for Buyers and Traders

Industry experts predict this momentum will continue through 2025, with sales remaining robust. As stock levels tighten further in the approach to March (when new registrations arrive), many believe used car retailers could find the market even more favourable. For consumers, however, this doesn’t have to mean paying over the odds. Shopping around for the right car, taking advantage of finance deals, and keeping an eye on changing offers can still yield good value.

If you’re in the market to buy or sell, staying informed is your best bet. Read reputable guides and data sources, and always consider car condition, market demand, and fuel-type.

Find out why 96% of our customers have rated us 4 stars or higher, by reading our reviews on Feefo.