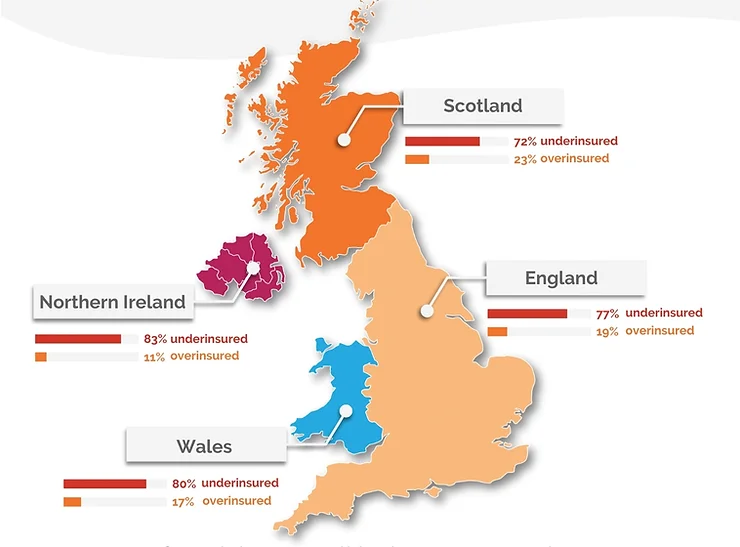

Picture this: you own a property, pay your insurance premiums diligently, and sleep soundly knowing your building is covered. But what if I told you that 76% of UK properties are underinsured? That’s more than three-quarters of buildings potentially leaving their owners in for a rude awakening should disaster strike.

Despite recent improvements, this figure is a six-year low, it remains unacceptably high.

Why is underinsurance so common?

The gap between insured values and true rebuild costs has been widening for years, primarily due to construction inflation. Rising costs of materials and labour mean the price of rebuilding after a fire, flood, or other catastrophe is often far higher than the insured amount.

While the number of underinsured properties is slowly falling, the coverage gap remains vast. In fact, properties underinsured today are covered for an average of just 63% of what they should be, a troubling statistic that hasn’t improved since last year.

“The gap between insurance levels and true rebuild cost has widened in recent years due to construction inflation and there are no signs yet that this gap is starting to close, However, when we look at our latest 34,000 buildings valuations, we do see signs that the number of underinsured buildings is starting to fall. Is the underinsurance tide turning? Overall, I’d say the jury is still out, but there are some positive signs that the wider availability of lower cost valuations, through desktop assessments, for example, is beginning to have an impact.” – Johnny Thomson, Marketing and Communications Director at rebuildcostassessment.com

The cost of underinsurance

Let’s break this down: for every ten properties, roughly two are overinsured, one is insured correctly, and the remaining seven are underinsured. That means property owners could be facing significant out-of-pocket expenses when disaster strikes, often at the worst possible time. The financial toll of underinsurance is only part of the issue. The emotional stress, frustration, and potential delays are enough to keep anyone awake at night.

An underinsurance clause in a property insurance policy reduces the amount an insurer will pay out if the insured value of the property is less than its actual value. This is also known as the average clause.

How it works: If a property is underinsured, the insurer will only pay a percentage of the claim. The percentage paid is based on the ratio of the insured value to the actual value. The policyholder is responsible for paying the remaining cost.

Example of ‘Average’ being applied

- A commercial property is insured for £100,000 (based on market value), but the actual cost to rebuild

the property is £200,000. - As the premium was based on the understanding that the sum insured for rebuilding was £100,000,

the claim settlement would be reduced by 50%. - The repairs cost £10,000, but as the customer was under-insured by 50%, they would receive only £5,000 in settlement.

Source: AXA Underinsurance Guide

The commercial property angle

When it comes to commercial properties, the situation is even more dire. According to rebuildcostassessment.com, 79% of commercial properties in the UK are underinsured. Considering these buildings often house businesses and livelihoods, the stakes couldn’t be higher. Research from Gallagher in late 2022 revealed that two in five UK commercial properties were underinsured by an average of 43%. This is a sobering reminder of how critical accurate building valuations are for protecting investments.

Plan Insurance can accommodate your Property Owners & Landlord Insurance needs. Just fill in our short call back form, and our professional brokers will be in contact to arrange your insurance.

The role of rebuild cost assessments

So, what’s being done about it? The good news is that rebuild cost assessments are helping to close the gap. Firms like rebuildcostassessment.com conduct around 4,000 property valuations monthly, providing accurate estimates to brokers, insurers, and property owners. Lower-cost options, like desktop assessments, have also made valuations more accessible.

However, Thomson notes there’s still a long way to go. While rebuild cost assessments are progressing, the regular use surveys to accurately determine sums insured, either via a desktop solution or an in person expert visit, is not sufficiently common.

How to protect your property

If you’re a property owner, it’s time to ask yourself: when was the last time your property’s rebuild cost was assessed? If it’s been more than a few years, or never, there’s a good chance you’re underinsured. Regular valuations ensure your insurance policy reflects current rebuild costs, protecting you from nasty surprises down the road.

For businesses, engaging with brokers who prioritise accurate valuations can make all the difference. Brokers can help navigate solutions like rebuild cost assessments, ensuring your coverage keeps pace with rising construction costs.

A path forward

The tide may be turning on underinsurance, but the jury’s still out. To truly tackle this issue, collaboration across the insurance industry is vital. Insurers, brokers, and property owners must work together to prioritise regular valuations and address insurance shortfalls. After all, the goal is simple: to ensure claims payments meet expectations and prevent unnecessary financial and emotional stress.

So, whether you own a small flat or a sprawling commercial building, take a moment to review your insurance coverage. It could be the smartest move you make all year.

Find out why 96% of our customers have rated us 4 stars or higher, by reading our reviews on Feefo.