DVLA Delay Scrapping Paper Section of Driving Licences

Hold off with that shredder! The DVLA (Driver and Vehicle Licensing Agency) have announced a delay for the implementation of their plans to remove the need for paper counterpart section driving licences. The change will be postponed until June 8th 2015.

At Plan Insurance we have concerns regarding the removal of the paper counterpart section. We fear it could result in online licence search costs being passed onto motorists via their insurance premiums.

Much like the removal for the need to display Road Tax in vehicle windows that came into effect at the start of October, the proposed abolishment of the paper counterpart section received little coverage in national media. The DVLA failed to make drivers aware of the proposed changes via a large scale press campaign.

The removal of the counterpart section was originally scheduled to come into force on January 1st 2015. However the deadline has been delayed by half a year. This is to allow for comprehensive checks that the new processes for verifying licence details are up to the required standard.

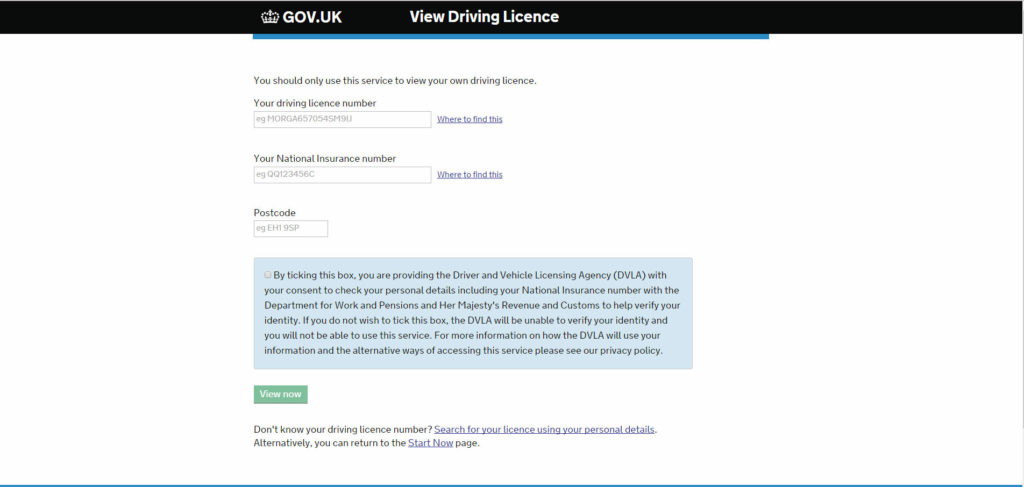

The paper counterpart of a driving licence has many uses for motorists. They can be used to see how many penalty points they have, when they expire, what classes of vehicles they can drive and when the document itself will expire. The DVLA are aiming to completely replace it with their online Driving Licence Viewer. Motorists are simply required to enter their driving licence number, national insurance number and postcode to perform a free search.

However, it was feared that the streamlining process was being rushed through. From the outside it appears there was pressure to to achieve cost saving targets. This pressure might compromised thorough analysis of the potential implications. The online service is for personal use only. Many interested parties will require access to prove drivers do not have poor driving records. Company vehicle fleet managers, holiday hire car rental firms as well as insurance brokers & companies would require access. A sudden abolition of the counterpart section would render them unable to carry out necessary checks.

The DVLA have now announced that an online service to allow third parties to check details of motorists’ driving records will be developed before the paper section is abolished. The Electronic Driver Entitlement Checking Service or EDECS will provide real-time driving data. We are unsure at the moment how approval will be granted by the motorist in question to the concerned third party.

It is hoped EDECS will provide a modern solution to the the antiquated but functional paper counterpart section. The system’s development should enable law enforcement officers, insurers and employers to have access to driving records. That is providing the driver in question has granted authorisation. The police carry out roadside checks for many of our motor trade insurance clients. This normally occurs when an MID discrepancy comes light. Also without this access an insurer’s ability to reward safer drivers with lower premiums would be significantly impaired.

Licence search charges could be passed onto Insurance Premiums

At Plan Insurance we are a specialist insurance brokerage arranging taxi and motor trade insurance cover for over 10,000 professional drivers. Therefore it was with both our own and our client’s interests in mind that we looked into the proposals for EDECS. We were very surprised to learn that the DVLA currently charge employers £5 for every licence check carried out despite the service being free for motorists to check the same information on their own licences’.

If this fee is rolled out to all parties wishing to use the online system it raises the very valid question as to, “Where will the revenue that the EDECS generates go?” The potential cost of these searchers will initially be incurred by insurers. With the scale of searches that the likes of; Aviva, Chaucer, NIG etc perform every year we’d imagine a lower rate for bulk buying could be negotiated with the DVLA. However the charges will no doubt still run into the millions. We fear any cost will inevitably be passed onto motorists in the form of higher motor insurance premiums

So on top of fuel duty, road tax, licence acquisition/renewal fees, taxi and motor trade insurance premiums, parking tickets and speeding fines our clients could be hit with another motoring cost. We remain surprised that the issue has received such little coverage in the media. We’ll keep you informed of any developments nearer to the amended launch date.