Flexible Fleet Insurance

For Couriers & Haulage Operators

At Plan Insurance Brokers we offer flexible, mileage-based insurance, backed by our industry-leading partners. Your company could save up to 80% on your premium when your vehicles are off the road.

As well as reducing premiums this innovative product will also effortlessly enhance your fleet risk management capabilities.

Call us on 0800 954 0778 to speak to one of our specialist advisors or request a call back.

Pay for what you use

Our mileage based policy means that when your vehicle is off the road, you can save up to 80% on your premium as you only pay the minimum base rate.

Simple set up

We help guide you through the whole process to get you started quickly and ensure a smooth and effortless transition.

Fantastic Support

You get access to a dedicated online Fleet portal and our expert teams will help you manage your insurance and risk management.

Cover we Offer

Your Insurance Solution

No matter the use or size of your fleet, Plan will arrange quality protection at a highly competitive premium. Our expert fleet team can offer innovative solutions. See their outstanding reviews.

Plan’s Guide to Pay Per Mile Fleet Insurance

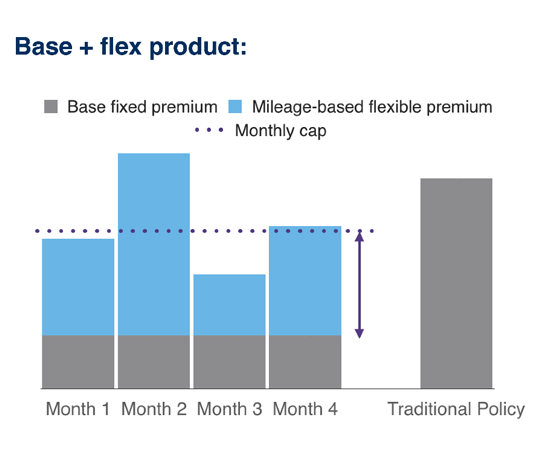

Pay Per Mile Fleet Insurance is like a traditional fleet policy in that it affords companies the convenience of having all their vehicles insured on one policy. However it has the added benefit of reducing in cost if the vehicles are under utilised. For firms that experience peaks in demand or have vehicles off the road for significant periods this can be a fantastic benefit.

A small sum will be charged as a base rate to cover the vehicles against risks such as fire and theft when they are not being driven. Then in addition to this amount regular payments will be made to the insurer based a cost per mile driven by each vehicle.

The mileage of each vehicle will be tracked using a telematics system. Fleet owners may have existing telematics in place on their vehicles. If so, this system may be used or there is potential for a contribution to be made by the insurer towards the cost of a new telematics system.

The use of telematics doesn’t just provide reports on the mileage covered. Detailed feedback can be obtained on the driving style and habits of each driver on the fleet policy. This information can prove vital in improving the performance of the drivers via training. These enhancements can then assist with generating a significant reduction in claims costs which in turn leads to lower insurance premiums.

Our insurer partners offer cover businesses with more than five vehicles. Pay Per Mile Fleet Insurance policies will provide cover for various business uses including taxi, private hire, courier and own goods haulage. A mixture of commercial vehicle types and private cars can be insured under one pay per mile fleet policy.

Pay per mile fleet insurance is proving incredibly popular with our clients. During the Covid-19 pandemic it provided fantastic flexibility for a number of firms and greatly aided their cash flow management. We have written a blog discussing how it is also a very useful insurance solution for amazon contractors and other courier firms.

A pay per mile fleet insurance policy can be arranged to provide cover for a variety of different uses including:

- Couriers

- Hire and Reward

- Private Hire

- Haulage

- Social, Domestic and Pleasure

- Third party or Comprehensive

- Goods in Transit

Vehicles covered on a pay per mile fleet policy

Our pay per mile fleet insurer partners will provide cover for a wide range of vehicles including:

- Cars

- Vans

- Tippers

- Flatbeds

- Curtain-side Trucks

- Tail Lift Trucks

- Articulated Lorries

- Busses

- Coaches

- Agricultural Vehicles

- Special Types such as Forklifts

Clients of Plan Insurance Brokers benefit from a number of incredibly useful risk management services at no extra cost. These apply to a wide number of business functions and include both motor based risks, property and numerous trade activities.

Please follow this link to find details of these additional risk management services for fleet operators.

A pay per mile fleet insurance will provide a confirmed fleet claims experience report as opposed to no claims bonus. With the enhanced risk management capabilities that a pay per mile fleet policy can offer, it would be hoped that this claims experience report will demonstrate a suitably strong performance of your fleet in order to generate policy premium savings, much like a NCB.

We have deep knowledge and an excellent panel of insurers for the below product range: