March proved to be the record month for new car registrations in the UK since records began. The UK’s automotive industry is pleading with the government to secure a favourable deal to keep business booming.

Plan Insurance Brokers have crunched the numbers provided by the industry’s leading organisations and analysed who needs a deal most – the UK or the EU?

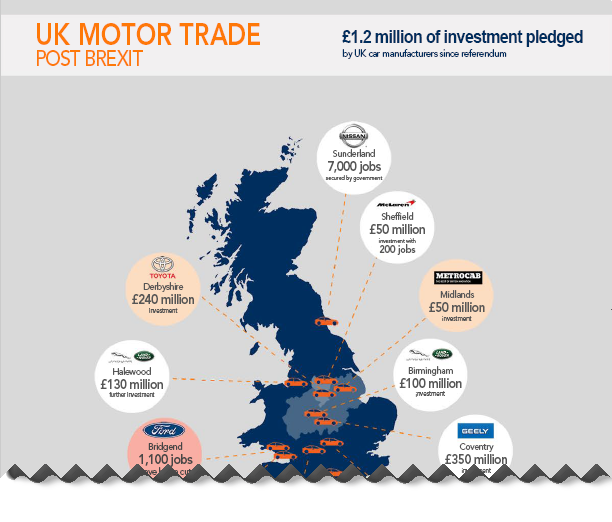

Click on the image to see the full infographic.

- £1.2 Billion pledged by Motor Manufacturers in 9 months post Brexit appears significantly down compared to previous years.

- Automotive industry supports over 810,000 jobs

- Exports to the EU make up 60% of the UK’s trade in vehicles.

- EU exports to UK account for only 15% of its automotive trade.

Are car manufacturers reversing out of the UK?

So far, since the country voted for Brexit, UK based motor manufacturers have pledged investment of £1.2 Billion. The Society of Motor Manufacturers &Traders (SMMT) estimated the automotive industry as a whole (including parts suppliers) pumped £2.5bn into research and development in 2015.

Post Brexit public announcements have been made by some of the sector’s biggest names including: Nissan, Jaguar Land Rover and Geely. These companies will continue to fund development at UK sites that will hopefully be sufficient to sustain 810,000 automotive industry dependent jobs.

Regions where these key automotive investments have been pledged were confident in the UK’s ability to go it alone:

- 11 out of 12 regions that will receive investment voted in favour of leaving the EU.

- Sunderland was by the far the most eager with the support for Brexit there ranked 81st in the country out of 399 constituencies.

- Ironically Oxford, home of BMW Mini a manufacturer yet to commit future finances to the UK publicly, was the only motor manufacturing region to come out in favour of the remain campaign.

The areas that will benefit from these recent funding announcements are spread right across the country. Though the midlands appears to be emerging as an automotive hub for the UK once again and several sites also fall in the catchment area of the governments’ much heralded, “Northern Powerhouse”.

“We need government to deliver a deal which includes participation in the customs union to help safeguard EU trade, trade that is tariff-free and avoids the non-tariff and regulatory barriers that would jeopardise investment, growth and consumer choice. Achieving this will not be easy and we must, at all costs, avoid a cliff-edge and reversion to WTO tariffs, which would threaten the viability of the industry.”

Mike Hawes, SMMT Chief Executive (speaking in January 2017)

Is a Brexit trade deal worth over twice as much to the UK than the EU?

Automotive exports to the EU make up almost 53% of the UK’s trade in vehicles. This equates to 12% of all UK exports. Although the EU sends vehicles valued at a total of €44.7 billion to the UK this only accounts for 23% of its motoring exports.

In an industry operating on relatively low margins, having the World Trade Organisation standard tariff of 10% imposed on imports could be incredibly damaging. Its estimate the average additional cost per vehicle could be £2,370.

The SMMT have urged the Prime Minister to secure access to the single market or at least tariff free trade. Failure to do so, they argue, would deal a serious blow to their target of increasing production in the UK from 1.7 million to 2 million vehicles by 2020.

“There’s a long road ahead and I’m sure there’ll be some bumps along the way but the economy has held up well since the referendum. The near 20% drop in the value of the pound has no doubt helped exporters in the short term.”

Investment pledges of around £1.2 Billion from car manufacturers since the referendum are a positive sign. However some decisions may have been tied to existing vehicle production cycles. We need producers to continue to support the UK’s economy and to back our workforce to continue to deliver.

It can’t be ignored that we’re negotiating with the EU on a deal that is far more significant to us in terms of GNP. The likelihood of being able to strong arm them seems unrealistic. Yet failure to secure any type of deal could hit both motor trade job numbers and consumer spending in the UK hard. “

Ryan Georgiades, Managing Director, Plan Insurance Brokers

Commercial Insurance – Motor Trade Insurance – Taxi and Private Hire Insurance

Plan Insurance Brokers are market leaders in motor trade insurance. The independent family business was established in 1989 by Peter Georgiades and management has since been taken over by his three sons. In 2016, Plan won the title of “Trade Insurance Provider of the Year” as voted for by the readers of Car Dealer Magazine, beating off competition from previous winners Allianz and Aviva.